What is it?

Your ATO payment details are available on the Australian Taxation Office (ATO) Portal. These are the payment details you would use to pay the ATO any BAS amounts your business owes.

These payment details are required if you are applying for a loan to refinance or consolidate your business' ATO debt. Lenders will usually pay out your debt with the ATO directly so they need to ensure that payment is made to the correct ATO payment account.

Steps to get your ATO payment details

Firstly, visit the ATO's Online Services for Business Login page.

Click the Login button.

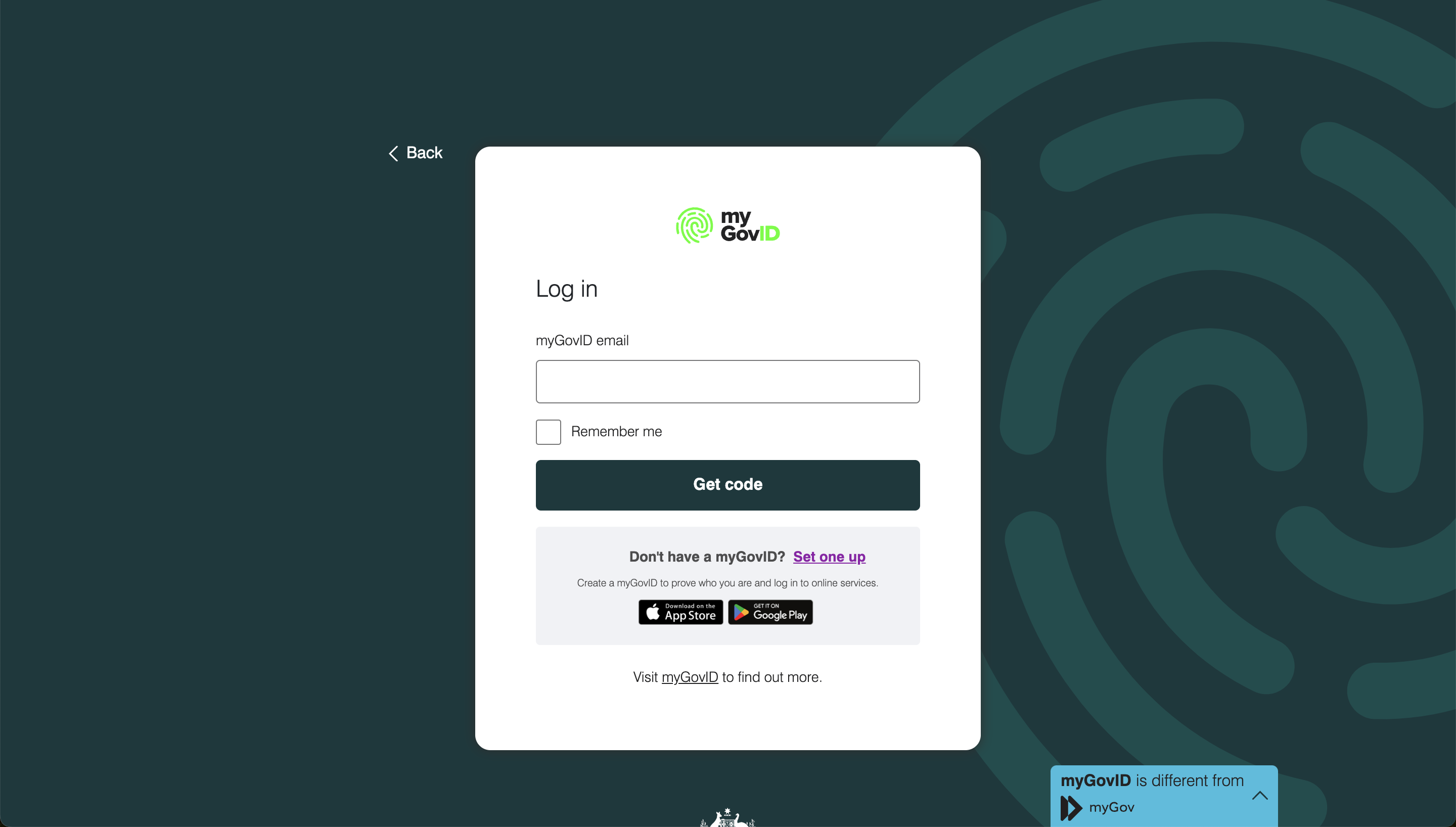

You will be directed to log in via the myGovID login screen.

If you don't have a myGovID set up, click the purple link "Set one up" to get started. If you have a myGovID, enter your registered email address and click the Get code button.

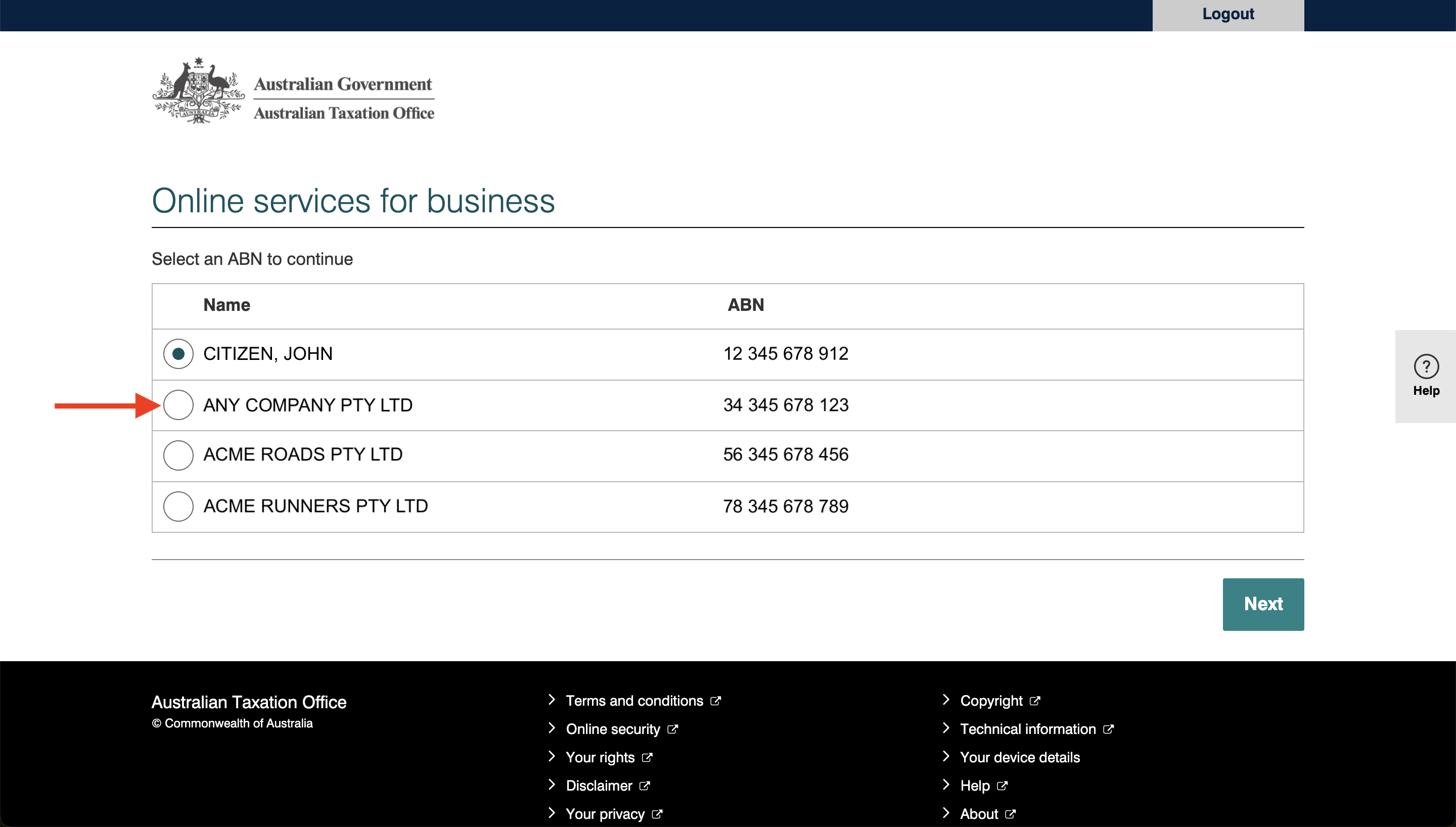

Once you've logged in successfully, you will be asked to choose the entity whose tax records you wish to access. Select the relevant entity for you and click the Next button.

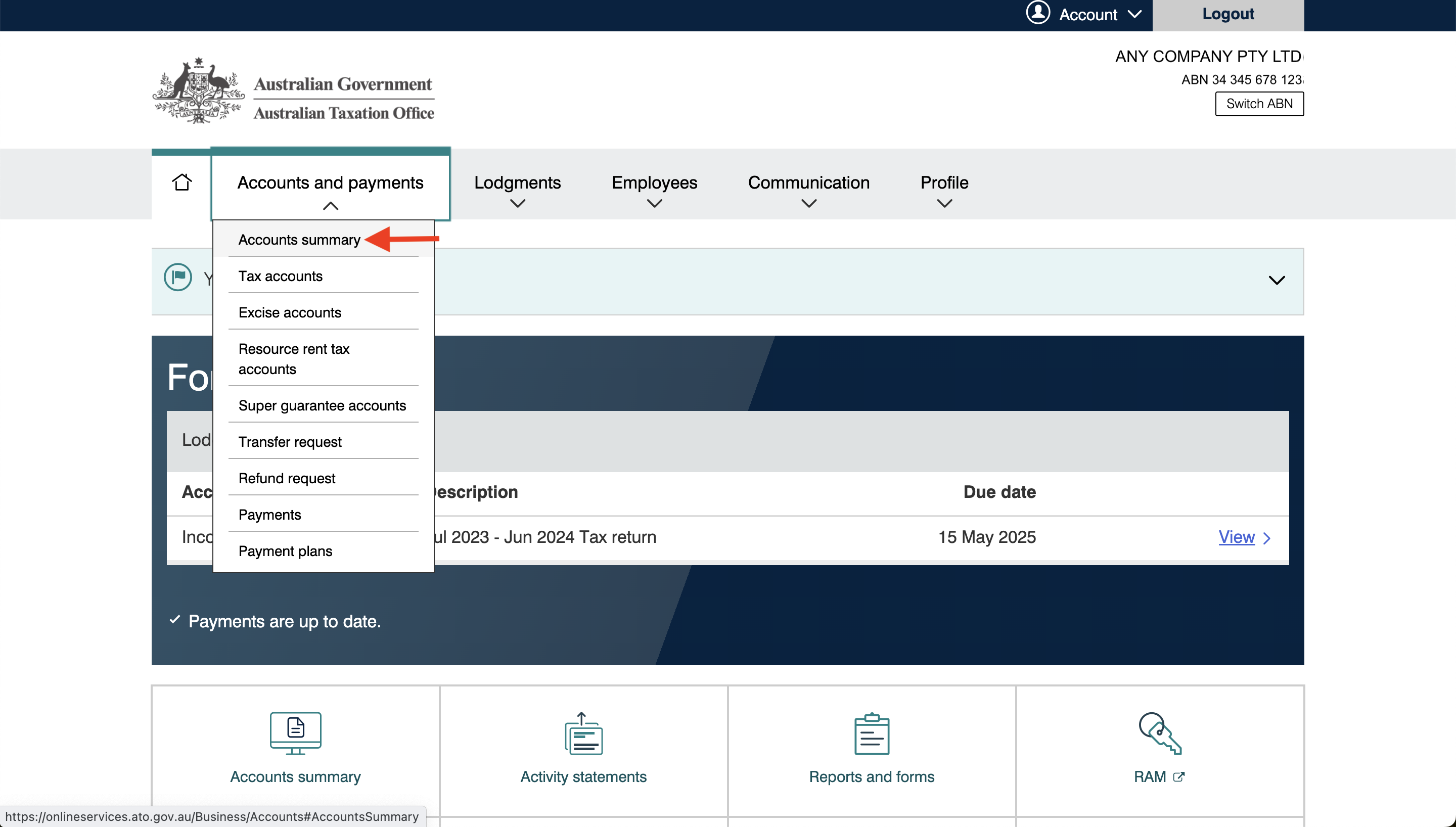

Next you will see the ATO home screen for the entity you selected. Click the Accounts and payments dropdown and select Accounts summary.

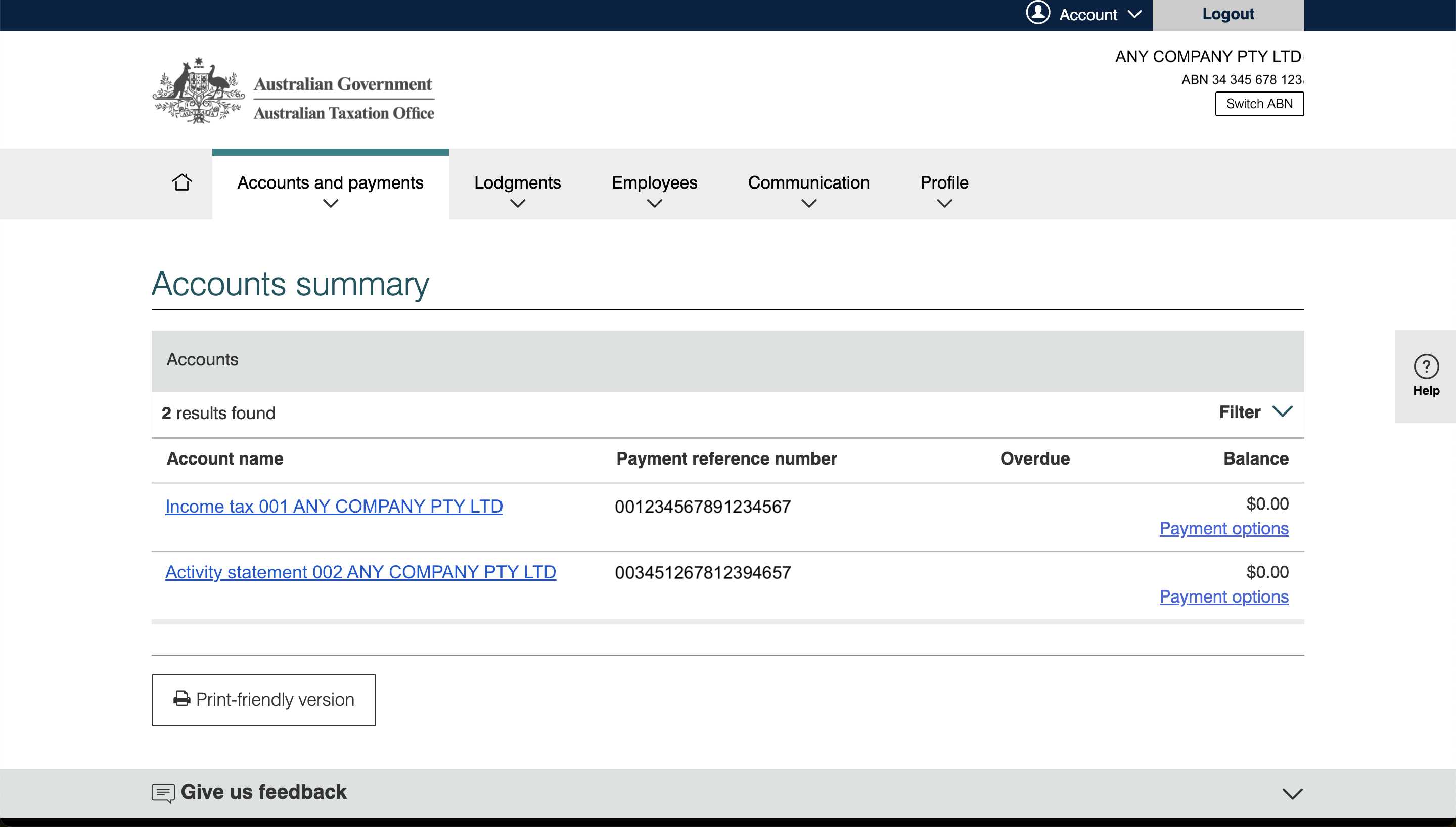

Now you will see the Accounts summary screen. It has a list of all the different tax accounts for your entity. Click the Payment options link for the entity's Activity statement.

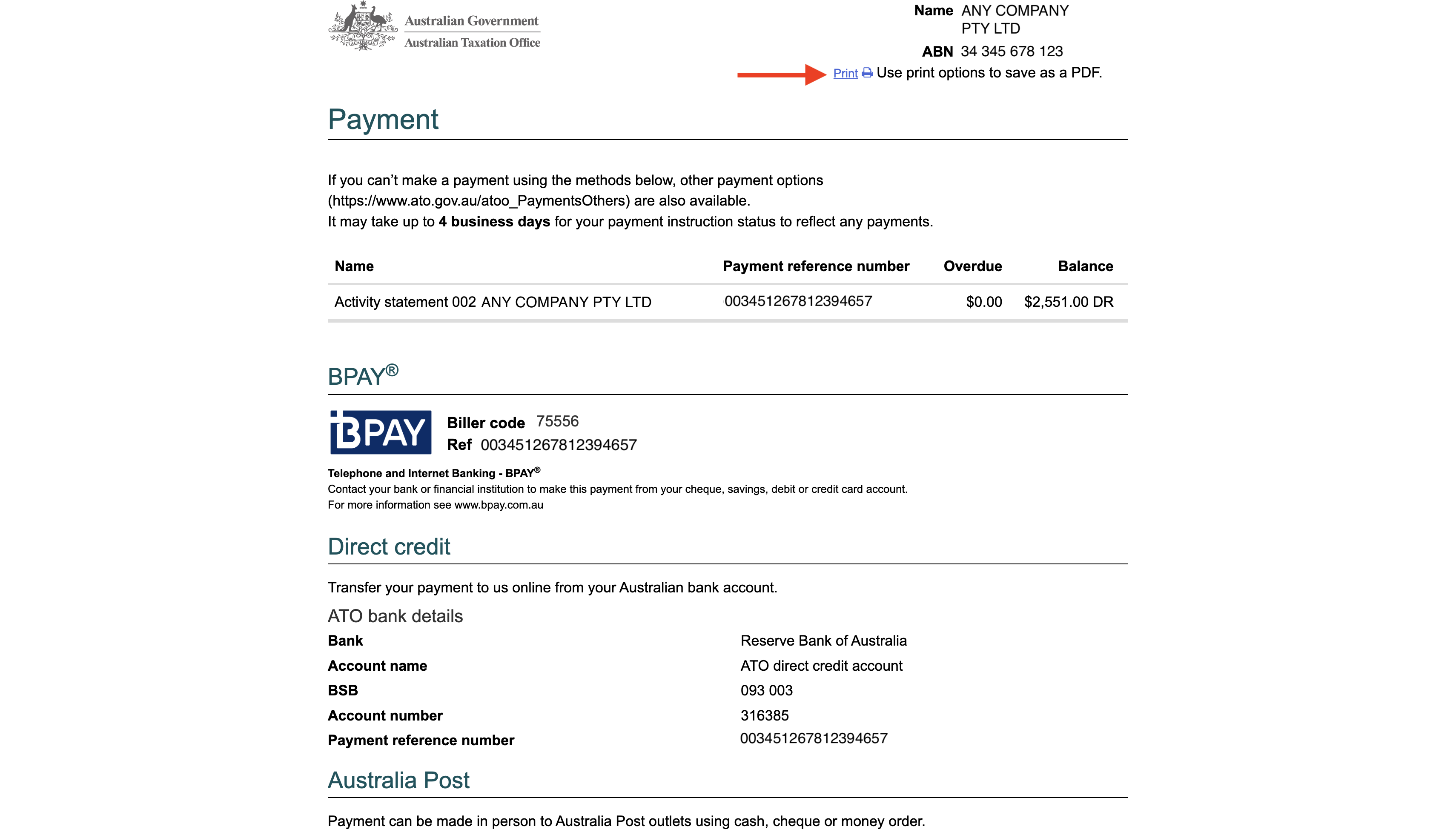

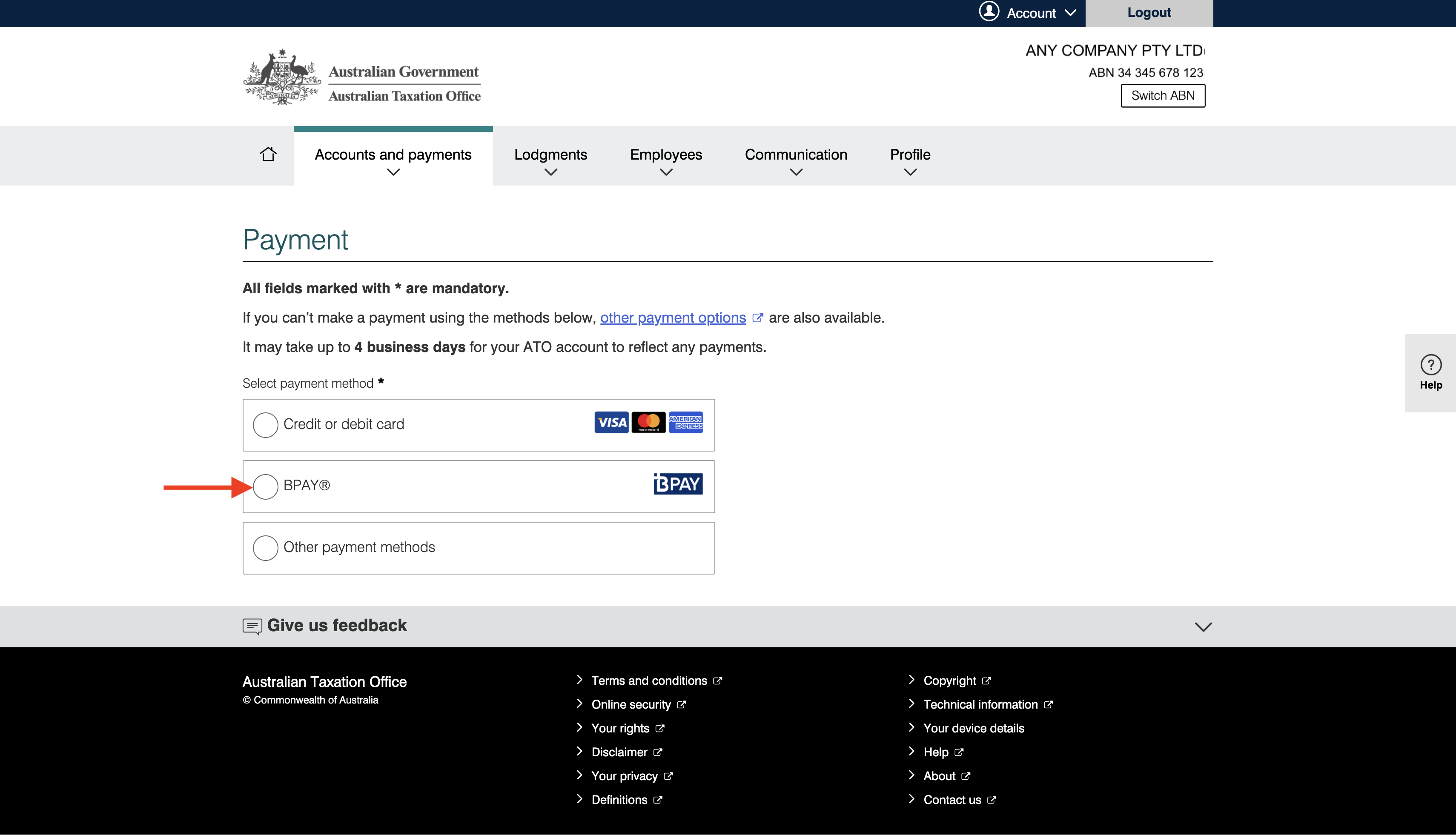

Next, you will see the Payment options screen. Select the BPAY option.

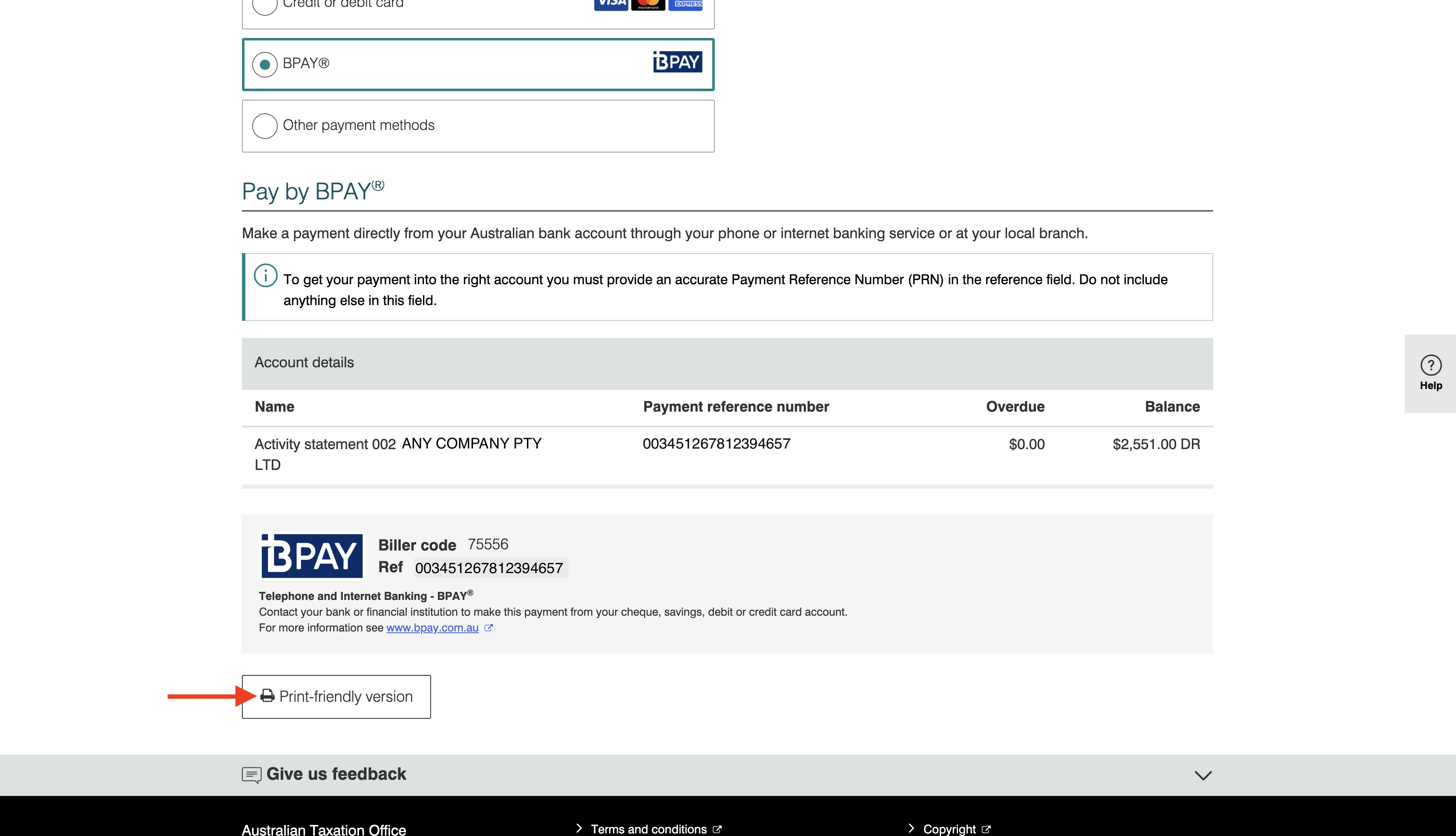

Next you will see the BPay payment details. Click the Print-friendly version button on the bottom left of the screen.

On the next screen click Print and save a PDF copy of your ATO payment details to share with your broker or lender.